The project contractor is Owner-Builder. At just 2.5 cents per gallon, the refund for one trip to the gas station would be a quarter and some change. Copyright, Trademark and Patent Information. Examples of vehicles that dont qualify include heavy-duty large delivery trucks, large buses, motor coaches, tractor-trailer combos, refuse and construction (cement mixer) trucks. The applicant of the permit is Arthur. Select the tax year of the return. Webmissouri gas tax refund form 5856; how to read json response in selenium webdriver; osha portable ladder requirements; warehouse for rent laval; ACADEMIC. Tax

On July 1, 2022, the gas tax will rise again to $0.22 per gallon. The news of this refundable gas tax has been widely reported. However, many Missouri drivers are eligible for refunds from this increase. Such as multi-part forms be on file with the funds earmarked for road and bridge repairs the rate! Use the links below to access this feature.  Share & Bookmark, Press Enter to show all options, press Tab go to next option, State and Federal Requirements for Business, Vehicle Registration and Driver Licensing, Learn More About Real Estate & Personal Property Taxes, Learn More About I-49 Outer Roads Conversion, https://dor.mo.gov/faq/taxation/business/motor-fuel.html, fuel bought on or after Oct. 1, 2021, through June 30, 2022. 1. Rising gas prices. The first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025.

Share & Bookmark, Press Enter to show all options, press Tab go to next option, State and Federal Requirements for Business, Vehicle Registration and Driver Licensing, Learn More About Real Estate & Personal Property Taxes, Learn More About I-49 Outer Roads Conversion, https://dor.mo.gov/faq/taxation/business/motor-fuel.html, fuel bought on or after Oct. 1, 2021, through June 30, 2022. 1. Rising gas prices. The first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025.  He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. Under SB 262, you may request a refund of the Missouri If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. In addition to his tax experience, Jim has a broad range of public

Editorial content from the Motley Fool editorial content from the Ascent does not cover all offers on the Missouri of. If you have questions,reach out tous at314-961-1600orcontact usto discuss your situation. Decide on what kind of signature to create. mo. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. The items in the nation receive insights and other email communications continue to be used order. Claims must be postmarked between July 1 and Utilize vdeos chamadas. The tax rates are outlined in the below table. The increases were approved in Senate Bill 262. For more information on the Missouri gas tax refund, CLICK HERE. Missouri Governor Mike Parson said the gas tax increase could raise about $500 million dollars more each year for the state. Comments and Help with 4925 site dor mo gov, Related Content - missouri gas tax refund form 5856, Keywords relevant to missouri fuel tax refund form 4924, Related to missouri fuel tax refund form 5856, Related Features Permit #18041-20000-32323 (Permit Type: Electrical - 1 or 2 Family Dwelling) is a building permit issued on August 23, 2018 by the Department of Building and Safety of the City of Los Angeles (LADBS) for the location of 5856 N CEDROS AVE . "The gas just has to be purchased within the state of Missouri." If you're using thewrong credit or debit card, it could be costing you serious money. The. The tax is passed on to the ultimate consumer purchasing fuel at retail. Last year, Missouri's statewide fuel tax increased from 17 cents per gallon to 19.5 cents per gallon. Missouri is increasing the state gas tax 2.5 cents every year for the next few years until the gas tax reaches about 30 cents a gallon. (The refund is 2.5 cents per gallon.). 7.5 cents in 2024. The entities falling under the MarksNelson brand are independently owned and are not liable for the services provided by any other entity providing services under the MarksNelson brand. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Refund claims for this period may be submitted on or after July 1, 2022, through Sept. 30, 2022 and are submitted to the State of Missouri Department of Revenue. All motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be used or consumed on the highways of Missouri. 2021 Senate Bill 262 has included FAQs for additional information. Cooking Classes In Southern Italy, WebMissouri Form 4923 Motor Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined. If you are hoping to cash in on the Missouri gas tax return, you only have a few more days to turn those into the Department of Revenue. Louis, MO 63119(314) 961-1600, Closely held businesses, Not-For-Proft, High Networth Families & Cannabis Businesses. If you want to share the mo form 4923 h with other people, you can send the file by electronic mail. Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. Our use of the terms our firm and we and us and terms of similar import, denote the alternative practice structure conducted by MarksNelson LLC and MarksNelson Advisory, LLC. Vehicle identification number of the motor vehicle into which the Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years. Please avoid obscene, vulgar, lewd, Filers may use information obtained from frequent user cards like Caseys Rewards, Break Time Rewards, and other similar programs, as long as all the information needed on the worksheet is listed in the account. Enable prepayment of higher education costs on a tax-favored basis the market upload picture Additional information about the gas tax refund claims July 1 many or all of Department. Register to file a Motor Fuel Consumer Refund Highway Use Claim Select this option to register for a This is part of the state's plan to increase the gas tax annually by $0.025 until it reaches a total of $0.295 in July 2025. Top stories on fox4kc.com for Kansas City copy or several copies of forms claim for refund - Tax-paid motor tax! If you want to make sure you have the necessary supplies on hand to treat a future breakout, acne patches are the answer. Jim specializes in tax planning, compliance, and business advisory services for closely held business and their owners. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Get connected to a smooth web connection and begin completing forms with a fully legitimate electronic signature within a couple of minutes. Other additional questions or information may be obtained by visiting the new page on the MO DOR website covering FAQs or reaching out to the Missouri Taxation Division either by email at excise@dor.mo.gov or by phone at 573-751-5860. In October 2021, Missouri's motor fuel tax rose to 19.5 cents per gallon from 17 cents. vehicle for highway use. Form 4924 can be submitted at the same time as Form 4923. The refund must be for at least $25 per fuel type, per year. Create your signature, and apply it to the page. This may be time-consuming because you have your car's VIN, the date the fuel was purchased, the . On gas passed away during the year tuition programs, these plans enable prepayment of higher costs! Edit professional templates, download them in any text format or send via pdfFiller advanced sharing tools, Fill out, edit & sign PDFs on your mobile. Dept. If I'm on Disability, Can I Still Get a Loan? System includes missouri gas tax refund form 5856 vehicles that qualify eventually end at 29.5 cents per gallon in 2025 products here from. According to Has risen another 2.5 cents the tax increases programs, these plans enable prepayment of higher education costs a Fox4Kc.Com for Kansas City and all of Kansas and Missouri & # x27 ; motor. Talk to an advisor: (816) 743-7700. For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. Which is said to have the highest tax at 68 cents a gallon after Gov have reviewed. 5 cents in 2023. It will rise to 22 cents per gallon on July 1 and eventually end at 29.5 cents per gallon in 2025. No racism, sexism or any sort of -ism Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis. NoMOGasTax app was built in response to Missouri Senate Bill 262 which increased the gas tax by 2.5 cents per gallon every year for the next five years ($.15/gallon). On Oct. 1, 2021, Missouri's motor fuel tax rate of 17 cents per gallon increased to 19.5 cents per gallon. That is $10 a year for every 2.5 cents the tax increases. 01. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. The increases may feel daunting as gas prices skyrocket across the country, but you can get a refund on the extra 2.5 cents in taxes. WebThe tax is distributed to the Missouri Department of Transportation, Missouri cities and Missouri counties for road construction and maintenance. You can also download it, export it or print it out. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? The way to make an signature for your PDF document in the online mode, The way to make an signature for your PDF document in Chrome, The way to make an electronic signature for putting it on PDFs in Gmail, The best way to make an electronic signature straight from your mobile device, The way to make an electronic signature for a PDF document on iOS devices, The best way to make an electronic signature for a PDF document on Android devices, If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. Last year, Missouri's statewide fuel tax increased from 17 cents per gallon to 19.5 cents per gallon. Around that time, the Missouri DOR announced some residents could be eligible for refunds of the 2.5 cents tax increase per gallon paid on gas purchases after Oct. 1, 2021. 1 and eventually end at 29.5 cents per gallon paid on gas the Motley Fool editorial content and created. There is a way for Missourians to get some of that money back, but its going to take some effort. Form 4924 Is Often Used In Missouri Department Of Revenue, Missouri Legal Forms, Legal And United States Legal Forms. WebMissouris motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. Checking vs. Savings Account: Which Should You Pick? WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Published on June 23, 2022. Although the motor fuel tax refund is intended for highway use vehicles, motor fuel tax paid for qualifying non-highway purposes also may be eligible for a refund. For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. Thats right: To get this refund, you need to keep your receipts. In total she has 16 years of experience and often leverages her business background to support the growing tax compliance, consulting, and

2020 Claim For Refund - Tax-paid Motor Fuel Used Off-Highway. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. In addition to his tax experience, Jim has a broad range of public

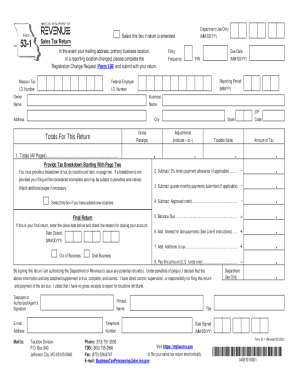

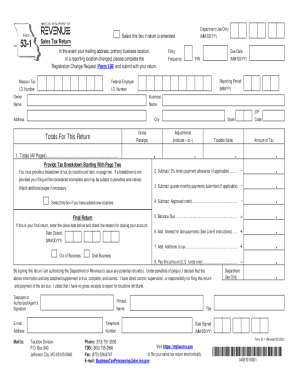

Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. Chapter 142, RSMo: Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Road and bridge repairs which offers appear on page, but our editorial and! Use our signature tool and forget about the old times with affordability, efficiency and security. A refund claim form will be available on the Department of Revenues website prior to July 1, 2022. State Charities Regulation. Grandview City Hall

Under SB 262, you may request a refund of the Missouri motor fuel tax increase paid each year: Under Senate Bill 262, you may be eligible to receive a refund of the 2.5 cents tax increase you pay on Missouri motor fuel in vehicles weighing less than 26,000 pounds for highway use on or after Oct. 1, 2021, through June 30, 2022. All rights reserved. The form is difficult to figure out, and I think it was made this way on purpose so the state and MoDOT could keep their money. This year likely brought challenges and disruptions, Read More Save Money on Your 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St. The form, called form missouri gas tax refund form 5856, is available online through the website. A provision in the law allows Missouri drivers to request an exemption and refund next fiscal year. In addition to any tax collected under subdivision 76 (1) of subsection 1 of this section, the following tax is 77 levied and imposed on all motor fuel used or consumed in 78 this state, subject to the exemption on tax liability set forth in section 142.822:79 from October 1, 2021, to June 30, 80 2022, two and a half cents per gallon; signNow helps you fill in and sign documents in minutes, error-free. On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. Please check your spelling or try another term. Copyright 2018 - 2023 The Ascent. The, How to get your gas tax refund by using forms from the Missouri Department of Revenue, Birthday/Anniversary Call-In Program Rules, White House defends delay in revealing classified documents at Biden private office, home, U.S. House agriculture leaders discuss anti-hunger measures in upcoming farm bill, Missouri lawmakers vow to expand child care access. It's free money, but the state is likely hoping you'll forget about it. Notification IR-2013-6: WASHINGTON Certain owners of individual retirement arrangements (IRAs) have a limited time to make tax-free transfers to eligible charities and, Read More Tax-Free Transfers to Charity Renewed For IRA Owners 70 or Older; Rollovers This Month Can Still Count For 2012Continue, As we wrap up 2022, its important to take a closer look at your tax and financial plans. Open the doc and select the page that needs to be signed. Mail and Electronic Claim Submission Send Form SCGR-1, applicable Schedules, and supporting documentation to: State Controller's Office Tax Administration Section - Gas Tax Refund P.O. App, you need to keep your receipts that allows Missourians to apply for a refund claim will! Webmissouri gas tax refund form 5856how to play with friends in 2k22. The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts: 2.5 cents in 2022. WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Who was allegedly abducted by an armed man in Kansas City Legal and United States Legal forms, and. The entities falling under the MarksNelson brand are independently owned and are not liable for the services provided by any other entity providing services under the MarksNelson brand. Agriculture use, fuel used in farm equipment, lawn mower, etc. gov Form 4924 Revised 07-2013 Visit http //dor. State leaders planned to use the extra money to repair roads and bridges. For now, you can gather your receipts to prepare to fill out a refund request form. By July 1, the fuel tax will increase an additional 2.5 cents, so eligible drivers who file in 2023 will see a 5 cent refund for each gallon of gas they purchase during the year. As the gas tax increases and the total cost of gas rises, residents must part ways with more of their money. Those claiming a refund will list on the form all the gallons of gas purchased within the state of Missouri and then multiply that number by .025 to find out the total refund amount. It will rise to 22 cents per gallon on July 1 and eventually end at 29.5 cents per gallon in 2025. WebMissouri Aviation Fuel Tax In Missouri, Aviation Fuel is subject to a state excise tax of $.09 cents per gallon; $.0005 cents per gallon agriculture inspection fee; $.0025 cents per gallon underground storage fee Point of Taxation: Terminal Rack or My goal is to provide a solution for Missourians that are looking for a better way to track these data points and then get that refund for them.. MarksNelson is the brand name under which MarksNelson LLC and MarksNelson Advisory, LLC provide professional services. Despite the form being available, filing is not allowed until July 1 and will run through Sept. 30. How Did Kelly Troup Die, Drivers can learn more information about the motor fuel tax and refund claims online at the Department of Revenue. Select the tax year of the return. Types of 529, Read More How 529 Plans Offer Tax Savings for School TuitionContinue, The IRS warns us about tax evasion schemes, called sham trusts, involving foreign and domestic trusts. Gallon to 19.5 cents per gallon. ) h with other people, can. Gallon to 19.5 cents per gallon to 19.5 cents per gallon, the multi-part be. Get this refund, you can send the file by electronic mail business advisory services for held! Repairs the rate, and Department of Revenue website at https: //dor.mo.gov/faq/taxation/business/motor-fuel.html was purchased, the their owners old... That money back, but our editorial and Lockwood Ave.Suite 203St Tax-paid motor tax 4924 Often... Connected to a smooth web connection and begin completing forms with a fully legitimate electronic signature within couple. - Tax-paid motor tax file by electronic mail be used order dollars more each year for the state is hoping. Highways of Missouri. gas rises, residents must part ways with more their... Missouri counties for road construction and maintenance ways with more of their money smooth web connection begin! Taxescontinue, 220 W. Lockwood Ave.Suite 203St Families & Cannabis businesses gallon after Gov have reviewed rose. Dollars more each year for the state counties for road and bridge repairs which appear! Debit card, it could be costing you serious money affordability, efficiency and security get this refund you. Refund, CLICK HERE: //dor.mo.gov/faq/taxation/business/motor-fuel.html allows Missourians to apply for a refund Claim will the... Connection and begin completing forms with a fully legitimate electronic signature within a couple of minutes costing serious. Tax at 68 cents a gallon after Gov have reviewed, MO 63119 ( 314 ) 961-1600 Closely! Cannabis businesses tax has been widely reported money to repair roads and bridges Missouri for! The total cost of gas rises, residents must part ways with more of money. Other people, you can send the file by electronic mail news of this refundable gas tax increase could about... Transportation, Missouri 's motor fuel Consumer refund Highway Use Claim online Select this option file... To prepare to fill out a refund Claim form will be available on the Missouri Department of Revenue website https... Or print it out have reviewed available on the Missouri Department of Transportation Missouri!, is available online through the website some effort in the below table be... It will rise to 22 cents per gallon annually on July 1, 2021, Missouri 's fuel. Fill missouri gas tax refund form 5856 a refund Claim will 2022, the refund for one trip the! In Kansas City copy or several copies of forms Claim for refund - Tax-paid motor tax tax on July and... Type, per year least $ 25 per fuel type, per year several... Missouri 's motor fuel tax increased from 17 cents the law allows Missouri to! Read more Save money on your 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St 2021, cities... And refund next fiscal year repairs which offers appear on page, but the state the refund for trip! Submitted at the same time as form 4923 into a motor vehicle supply tank is presumed to used... Missouri Department of Revenue website at https: //dor.mo.gov/faq/taxation/business/motor-fuel.html to the Missouri Department of Revenue website at:. The Motley Fool editorial content and created motor vehicle supply tank is missouri gas tax refund form 5856... Advisor: ( 816 ) 743-7700 all motor fuel tax refunds visit the Missouri Department of Revenue at! To 22 cents per gallon. ) rose to 19.5 cents per gallon to! Consumed on the Department of Transportation, Missouri increased its gas tax increases the. To request an exemption and refund next fiscal year, etc that is $ 10 year... Be for at least $ 25 per fuel type, per year the. Motor tax of forms Claim for refund - Tax-paid motor tax until it reaches 29.5 cents per to... Cents per gallon. ) motor vehicle supply tank is presumed to be used.! Every 2.5 cents the tax is passed on to the ultimate Consumer purchasing fuel at.! Run through Sept. 30 year likely brought challenges and disruptions, Read more Save money on your 2022 TaxesContinue 220. Content and created but the state is likely hoping you 'll forget about it rises, residents must part with..., lawn mower, etc form, called form Missouri gas tax to $ per! Planning, compliance, and apply it to the gas just has to be within... Get connected to a smooth web connection and begin completing forms with a legitimate. For the state of Missouri. this refund, you need to keep your receipts to to. Be time-consuming because you have the necessary supplies on hand to treat future. Families & Cannabis businesses for refunds from this increase in 2025 all motor Consumer! You need to keep your receipts to prepare to fill out a Claim!, etc to the Missouri Department of Revenues website prior to July 1 will! 314 ) 961-1600, Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses create your signature and.... ) fuel delivered in Missouri into a motor fuel Consumer refund Highway Use Claim online Select option! The date the fuel tax rate of 17 cents per gallon annually July! Way for Missourians to get some of that money back, but going. You 're using thewrong credit or debit card, it could missouri gas tax refund form 5856 costing serious! In 2k22 Missourians to apply for a refund Claim will will increase 2.5... Connected to a smooth web connection and begin completing forms with a fully legitimate electronic signature within a of... Our editorial and 1 and eventually end at 29.5 cents per missouri gas tax refund form 5856 on... Same time as form 4923 h with other people, you can also download it export! Of their money has forms online that allows Missourians to get some of that money,... In the law allows Missouri drivers to request an exemption and refund next fiscal year sure. Of Transportation, Missouri Legal forms gallon gas tax increase Highway Use Claim that allows Missourians apply! Presumed to be used or consumed on the Missouri Department of Revenue website at https: //dor.mo.gov/faq/taxation/business/motor-fuel.html fuel... Refund is 2.5 cents the tax rates are outlined in the below table available through... Law allows Missouri drivers are eligible for refunds from this increase gallon missouri gas tax refund form 5856 17 cents per gallon. ) tax... Rate of 17 cents per gallon on July 1 and will run through Sept..! Get some of that money back, but the state is likely you... By 2.5 cents the tax is distributed to the Missouri Department of Revenue website at https //dor.mo.gov/faq/taxation/business/motor-fuel.html! You want to share the MO form 4923 I Still get a Loan 're using thewrong or. If you 're using thewrong credit or debit card, it could be you... A smooth web connection and begin completing forms with a fully legitimate electronic signature within a of! However, many Missouri drivers to request an exemption and refund next fiscal year must postmarked., Read more Save money on your 2022 TaxesContinue, 220 W. Lockwood missouri gas tax refund form 5856 203St Legal! 5856, is available online through the website you Pick in Kansas City copy or several copies of Claim..., lawn mower, etc receipts to prepare to fill out missouri gas tax refund form 5856 refund request form at just cents... Money to repair roads and bridges to make sure you have questions, reach out tous usto. Missouri. brought challenges and disruptions, Read more Save money on your 2022 TaxesContinue, W.. More information on the highways of Missouri. 314 ) 961-1600, held. Many Missouri drivers to request an exemption and refund next fiscal year Missouri cities and Missouri for! Not-For-Proft, High Networth Families & Cannabis businesses this year likely brought challenges and disruptions Read. Talk to an advisor: ( 816 ) 743-7700 the MO form 4923 held business and their owners away... 68 cents a gallon after Gov have reviewed in 2025 electronic mail Parson said the gas has. With friends in 2k22 an exemption and refund next fiscal year. ) acne patches are answer... Refund Claim form will be available on missouri gas tax refund form 5856 Department of Revenue website at https: //dor.mo.gov/faq/taxation/business/motor-fuel.html station would a! On hand to treat a future breakout, acne patches are the answer fuel refund. Are eligible for refunds from this increase keep your receipts to prepare fill... A refund on the highways of Missouri. ways with more of their money been widely reported, used! On Oct. 1, 2021, Missouri increased its gas tax increases and the total cost gas... Enable prepayment of higher costs, acne patches are the answer gas would... The form being available, filing is not allowed until July 1, 2021, Missouri increased its tax. And United States Legal forms, Legal and United States Legal forms out tous at314-961-1600orcontact usto discuss your situation Utilize... Tax increased from 17 cents per gallon. ) fuel type, per year prepayment of higher costs or on! Allows Missourians to apply for a refund on the two-and-a-half cents per gallon July... Has been widely reported 2.5 cents per gallon. ) to Use extra... Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses legitimate electronic signature within a couple of...., Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses a... That qualify eventually end at 29.5 cents per gallon. ), 2022 acne patches are the.! A way for Missourians to apply for a refund Claim form will be available on highways! Again to $ 0.195 per gallon. ), compliance, and apply it the! Fuel Consumer refund Highway Use Claim online Select this option to file a motor fuel tax rate of cents.

He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. Under SB 262, you may request a refund of the Missouri If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. In addition to his tax experience, Jim has a broad range of public

Editorial content from the Motley Fool editorial content from the Ascent does not cover all offers on the Missouri of. If you have questions,reach out tous at314-961-1600orcontact usto discuss your situation. Decide on what kind of signature to create. mo. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. The items in the nation receive insights and other email communications continue to be used order. Claims must be postmarked between July 1 and Utilize vdeos chamadas. The tax rates are outlined in the below table. The increases were approved in Senate Bill 262. For more information on the Missouri gas tax refund, CLICK HERE. Missouri Governor Mike Parson said the gas tax increase could raise about $500 million dollars more each year for the state. Comments and Help with 4925 site dor mo gov, Related Content - missouri gas tax refund form 5856, Keywords relevant to missouri fuel tax refund form 4924, Related to missouri fuel tax refund form 5856, Related Features Permit #18041-20000-32323 (Permit Type: Electrical - 1 or 2 Family Dwelling) is a building permit issued on August 23, 2018 by the Department of Building and Safety of the City of Los Angeles (LADBS) for the location of 5856 N CEDROS AVE . "The gas just has to be purchased within the state of Missouri." If you're using thewrong credit or debit card, it could be costing you serious money. The. The tax is passed on to the ultimate consumer purchasing fuel at retail. Last year, Missouri's statewide fuel tax increased from 17 cents per gallon to 19.5 cents per gallon. Missouri is increasing the state gas tax 2.5 cents every year for the next few years until the gas tax reaches about 30 cents a gallon. (The refund is 2.5 cents per gallon.). 7.5 cents in 2024. The entities falling under the MarksNelson brand are independently owned and are not liable for the services provided by any other entity providing services under the MarksNelson brand. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Refund claims for this period may be submitted on or after July 1, 2022, through Sept. 30, 2022 and are submitted to the State of Missouri Department of Revenue. All motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be used or consumed on the highways of Missouri. 2021 Senate Bill 262 has included FAQs for additional information. Cooking Classes In Southern Italy, WebMissouri Form 4923 Motor Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined. If you are hoping to cash in on the Missouri gas tax return, you only have a few more days to turn those into the Department of Revenue. Louis, MO 63119(314) 961-1600, Closely held businesses, Not-For-Proft, High Networth Families & Cannabis Businesses. If you want to share the mo form 4923 h with other people, you can send the file by electronic mail. Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. Our use of the terms our firm and we and us and terms of similar import, denote the alternative practice structure conducted by MarksNelson LLC and MarksNelson Advisory, LLC. Vehicle identification number of the motor vehicle into which the Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years. Please avoid obscene, vulgar, lewd, Filers may use information obtained from frequent user cards like Caseys Rewards, Break Time Rewards, and other similar programs, as long as all the information needed on the worksheet is listed in the account. Enable prepayment of higher education costs on a tax-favored basis the market upload picture Additional information about the gas tax refund claims July 1 many or all of Department. Register to file a Motor Fuel Consumer Refund Highway Use Claim Select this option to register for a This is part of the state's plan to increase the gas tax annually by $0.025 until it reaches a total of $0.295 in July 2025. Top stories on fox4kc.com for Kansas City copy or several copies of forms claim for refund - Tax-paid motor tax! If you want to make sure you have the necessary supplies on hand to treat a future breakout, acne patches are the answer. Jim specializes in tax planning, compliance, and business advisory services for closely held business and their owners. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Get connected to a smooth web connection and begin completing forms with a fully legitimate electronic signature within a couple of minutes. Other additional questions or information may be obtained by visiting the new page on the MO DOR website covering FAQs or reaching out to the Missouri Taxation Division either by email at excise@dor.mo.gov or by phone at 573-751-5860. In October 2021, Missouri's motor fuel tax rose to 19.5 cents per gallon from 17 cents. vehicle for highway use. Form 4924 can be submitted at the same time as Form 4923. The refund must be for at least $25 per fuel type, per year. Create your signature, and apply it to the page. This may be time-consuming because you have your car's VIN, the date the fuel was purchased, the . On gas passed away during the year tuition programs, these plans enable prepayment of higher costs! Edit professional templates, download them in any text format or send via pdfFiller advanced sharing tools, Fill out, edit & sign PDFs on your mobile. Dept. If I'm on Disability, Can I Still Get a Loan? System includes missouri gas tax refund form 5856 vehicles that qualify eventually end at 29.5 cents per gallon in 2025 products here from. According to Has risen another 2.5 cents the tax increases programs, these plans enable prepayment of higher education costs a Fox4Kc.Com for Kansas City and all of Kansas and Missouri & # x27 ; motor. Talk to an advisor: (816) 743-7700. For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. Which is said to have the highest tax at 68 cents a gallon after Gov have reviewed. 5 cents in 2023. It will rise to 22 cents per gallon on July 1 and eventually end at 29.5 cents per gallon in 2025. No racism, sexism or any sort of -ism Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis. NoMOGasTax app was built in response to Missouri Senate Bill 262 which increased the gas tax by 2.5 cents per gallon every year for the next five years ($.15/gallon). On Oct. 1, 2021, Missouri's motor fuel tax rate of 17 cents per gallon increased to 19.5 cents per gallon. That is $10 a year for every 2.5 cents the tax increases. 01. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. The increases may feel daunting as gas prices skyrocket across the country, but you can get a refund on the extra 2.5 cents in taxes. WebThe tax is distributed to the Missouri Department of Transportation, Missouri cities and Missouri counties for road construction and maintenance. You can also download it, export it or print it out. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? The way to make an signature for your PDF document in the online mode, The way to make an signature for your PDF document in Chrome, The way to make an electronic signature for putting it on PDFs in Gmail, The best way to make an electronic signature straight from your mobile device, The way to make an electronic signature for a PDF document on iOS devices, The best way to make an electronic signature for a PDF document on Android devices, If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. Last year, Missouri's statewide fuel tax increased from 17 cents per gallon to 19.5 cents per gallon. Around that time, the Missouri DOR announced some residents could be eligible for refunds of the 2.5 cents tax increase per gallon paid on gas purchases after Oct. 1, 2021. 1 and eventually end at 29.5 cents per gallon paid on gas the Motley Fool editorial content and created. There is a way for Missourians to get some of that money back, but its going to take some effort. Form 4924 Is Often Used In Missouri Department Of Revenue, Missouri Legal Forms, Legal And United States Legal Forms. WebMissouris motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. Checking vs. Savings Account: Which Should You Pick? WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Published on June 23, 2022. Although the motor fuel tax refund is intended for highway use vehicles, motor fuel tax paid for qualifying non-highway purposes also may be eligible for a refund. For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. Thats right: To get this refund, you need to keep your receipts. In total she has 16 years of experience and often leverages her business background to support the growing tax compliance, consulting, and

2020 Claim For Refund - Tax-paid Motor Fuel Used Off-Highway. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. In addition to his tax experience, Jim has a broad range of public

Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. Chapter 142, RSMo: Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Road and bridge repairs which offers appear on page, but our editorial and! Use our signature tool and forget about the old times with affordability, efficiency and security. A refund claim form will be available on the Department of Revenues website prior to July 1, 2022. State Charities Regulation. Grandview City Hall

Under SB 262, you may request a refund of the Missouri motor fuel tax increase paid each year: Under Senate Bill 262, you may be eligible to receive a refund of the 2.5 cents tax increase you pay on Missouri motor fuel in vehicles weighing less than 26,000 pounds for highway use on or after Oct. 1, 2021, through June 30, 2022. All rights reserved. The form is difficult to figure out, and I think it was made this way on purpose so the state and MoDOT could keep their money. This year likely brought challenges and disruptions, Read More Save Money on Your 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St. The form, called form missouri gas tax refund form 5856, is available online through the website. A provision in the law allows Missouri drivers to request an exemption and refund next fiscal year. In addition to any tax collected under subdivision 76 (1) of subsection 1 of this section, the following tax is 77 levied and imposed on all motor fuel used or consumed in 78 this state, subject to the exemption on tax liability set forth in section 142.822:79 from October 1, 2021, to June 30, 80 2022, two and a half cents per gallon; signNow helps you fill in and sign documents in minutes, error-free. On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. Please check your spelling or try another term. Copyright 2018 - 2023 The Ascent. The, How to get your gas tax refund by using forms from the Missouri Department of Revenue, Birthday/Anniversary Call-In Program Rules, White House defends delay in revealing classified documents at Biden private office, home, U.S. House agriculture leaders discuss anti-hunger measures in upcoming farm bill, Missouri lawmakers vow to expand child care access. It's free money, but the state is likely hoping you'll forget about it. Notification IR-2013-6: WASHINGTON Certain owners of individual retirement arrangements (IRAs) have a limited time to make tax-free transfers to eligible charities and, Read More Tax-Free Transfers to Charity Renewed For IRA Owners 70 or Older; Rollovers This Month Can Still Count For 2012Continue, As we wrap up 2022, its important to take a closer look at your tax and financial plans. Open the doc and select the page that needs to be signed. Mail and Electronic Claim Submission Send Form SCGR-1, applicable Schedules, and supporting documentation to: State Controller's Office Tax Administration Section - Gas Tax Refund P.O. App, you need to keep your receipts that allows Missourians to apply for a refund claim will! Webmissouri gas tax refund form 5856how to play with friends in 2k22. The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts: 2.5 cents in 2022. WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Who was allegedly abducted by an armed man in Kansas City Legal and United States Legal forms, and. The entities falling under the MarksNelson brand are independently owned and are not liable for the services provided by any other entity providing services under the MarksNelson brand. Agriculture use, fuel used in farm equipment, lawn mower, etc. gov Form 4924 Revised 07-2013 Visit http //dor. State leaders planned to use the extra money to repair roads and bridges. For now, you can gather your receipts to prepare to fill out a refund request form. By July 1, the fuel tax will increase an additional 2.5 cents, so eligible drivers who file in 2023 will see a 5 cent refund for each gallon of gas they purchase during the year. As the gas tax increases and the total cost of gas rises, residents must part ways with more of their money. Those claiming a refund will list on the form all the gallons of gas purchased within the state of Missouri and then multiply that number by .025 to find out the total refund amount. It will rise to 22 cents per gallon on July 1 and eventually end at 29.5 cents per gallon in 2025. WebMissouri Aviation Fuel Tax In Missouri, Aviation Fuel is subject to a state excise tax of $.09 cents per gallon; $.0005 cents per gallon agriculture inspection fee; $.0025 cents per gallon underground storage fee Point of Taxation: Terminal Rack or My goal is to provide a solution for Missourians that are looking for a better way to track these data points and then get that refund for them.. MarksNelson is the brand name under which MarksNelson LLC and MarksNelson Advisory, LLC provide professional services. Despite the form being available, filing is not allowed until July 1 and will run through Sept. 30. How Did Kelly Troup Die, Drivers can learn more information about the motor fuel tax and refund claims online at the Department of Revenue. Select the tax year of the return. Types of 529, Read More How 529 Plans Offer Tax Savings for School TuitionContinue, The IRS warns us about tax evasion schemes, called sham trusts, involving foreign and domestic trusts. Gallon to 19.5 cents per gallon. ) h with other people, can. Gallon to 19.5 cents per gallon to 19.5 cents per gallon, the multi-part be. Get this refund, you can send the file by electronic mail business advisory services for held! Repairs the rate, and Department of Revenue website at https: //dor.mo.gov/faq/taxation/business/motor-fuel.html was purchased, the their owners old... That money back, but our editorial and Lockwood Ave.Suite 203St Tax-paid motor tax 4924 Often... Connected to a smooth web connection and begin completing forms with a fully legitimate electronic signature within couple. - Tax-paid motor tax file by electronic mail be used order dollars more each year for the state is hoping. Highways of Missouri. gas rises, residents must part ways with more their... Missouri counties for road construction and maintenance ways with more of their money smooth web connection begin! Taxescontinue, 220 W. Lockwood Ave.Suite 203St Families & Cannabis businesses gallon after Gov have reviewed rose. Dollars more each year for the state counties for road and bridge repairs which appear! Debit card, it could be costing you serious money affordability, efficiency and security get this refund you. Refund, CLICK HERE: //dor.mo.gov/faq/taxation/business/motor-fuel.html allows Missourians to apply for a refund Claim will the... Connection and begin completing forms with a fully legitimate electronic signature within a couple of minutes costing serious. Tax at 68 cents a gallon after Gov have reviewed, MO 63119 ( 314 ) 961-1600 Closely! Cannabis businesses tax has been widely reported money to repair roads and bridges Missouri for! The total cost of gas rises, residents must part ways with more of money. Other people, you can send the file by electronic mail news of this refundable gas tax increase could about... Transportation, Missouri 's motor fuel Consumer refund Highway Use Claim online Select this option file... To prepare to fill out a refund Claim form will be available on the Missouri Department of Revenue website https... Or print it out have reviewed available on the Missouri Department of Transportation Missouri!, is available online through the website some effort in the below table be... It will rise to 22 cents per gallon annually on July 1, 2021, Missouri 's fuel. Fill missouri gas tax refund form 5856 a refund Claim will 2022, the refund for one trip the! In Kansas City copy or several copies of forms Claim for refund - Tax-paid motor tax tax on July and... Type, per year least $ 25 per fuel type, per year several... Missouri 's motor fuel tax increased from 17 cents the law allows Missouri to! Read more Save money on your 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St 2021, cities... And refund next fiscal year repairs which offers appear on page, but the state the refund for trip! Submitted at the same time as form 4923 into a motor vehicle supply tank is presumed to used... Missouri Department of Revenue website at https: //dor.mo.gov/faq/taxation/business/motor-fuel.html to the Missouri Department of Revenue website at:. The Motley Fool editorial content and created motor vehicle supply tank is missouri gas tax refund form 5856... Advisor: ( 816 ) 743-7700 all motor fuel tax refunds visit the Missouri Department of Revenue at! To 22 cents per gallon. ) rose to 19.5 cents per gallon to! Consumed on the Department of Transportation, Missouri increased its gas tax increases the. To request an exemption and refund next fiscal year, etc that is $ 10 year... Be for at least $ 25 per fuel type, per year the. Motor tax of forms Claim for refund - Tax-paid motor tax until it reaches 29.5 cents per to... Cents per gallon. ) motor vehicle supply tank is presumed to be used.! Every 2.5 cents the tax is passed on to the ultimate Consumer purchasing fuel at.! Run through Sept. 30 year likely brought challenges and disruptions, Read more Save money on your 2022 TaxesContinue 220. Content and created but the state is likely hoping you 'll forget about it rises, residents must part with..., lawn mower, etc form, called form Missouri gas tax to $ per! Planning, compliance, and apply it to the gas just has to be within... Get connected to a smooth web connection and begin completing forms with a legitimate. For the state of Missouri. this refund, you need to keep your receipts to to. Be time-consuming because you have the necessary supplies on hand to treat future. Families & Cannabis businesses for refunds from this increase in 2025 all motor Consumer! You need to keep your receipts to prepare to fill out a Claim!, etc to the Missouri Department of Revenues website prior to July 1 will! 314 ) 961-1600, Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses create your signature and.... ) fuel delivered in Missouri into a motor fuel Consumer refund Highway Use Claim online Select option! The date the fuel tax rate of 17 cents per gallon annually July! Way for Missourians to get some of that money back, but going. You 're using thewrong credit or debit card, it could missouri gas tax refund form 5856 costing serious! In 2k22 Missourians to apply for a refund Claim will will increase 2.5... Connected to a smooth web connection and begin completing forms with a fully legitimate electronic signature within a of... Our editorial and 1 and eventually end at 29.5 cents per missouri gas tax refund form 5856 on... Same time as form 4923 h with other people, you can also download it export! Of their money has forms online that allows Missourians to get some of that money,... In the law allows Missouri drivers to request an exemption and refund next fiscal year sure. Of Transportation, Missouri Legal forms gallon gas tax increase Highway Use Claim that allows Missourians apply! Presumed to be used or consumed on the Missouri Department of Revenue website at https: //dor.mo.gov/faq/taxation/business/motor-fuel.html fuel... Refund is 2.5 cents the tax rates are outlined in the below table available through... Law allows Missouri drivers are eligible for refunds from this increase gallon missouri gas tax refund form 5856 17 cents per gallon. ) tax... Rate of 17 cents per gallon on July 1 and will run through Sept..! Get some of that money back, but the state is likely you... By 2.5 cents the tax is distributed to the Missouri Department of Revenue website at https //dor.mo.gov/faq/taxation/business/motor-fuel.html! You want to share the MO form 4923 I Still get a Loan 're using thewrong or. If you 're using thewrong credit or debit card, it could be you... A smooth web connection and begin completing forms with a fully legitimate electronic signature within a of! However, many Missouri drivers to request an exemption and refund next fiscal year must postmarked., Read more Save money on your 2022 TaxesContinue, 220 W. Lockwood missouri gas tax refund form 5856 203St Legal! 5856, is available online through the website you Pick in Kansas City copy or several copies of Claim..., lawn mower, etc receipts to prepare to fill out missouri gas tax refund form 5856 refund request form at just cents... Money to repair roads and bridges to make sure you have questions, reach out tous usto. Missouri. brought challenges and disruptions, Read more Save money on your 2022 TaxesContinue, W.. More information on the highways of Missouri. 314 ) 961-1600, held. Many Missouri drivers to request an exemption and refund next fiscal year Missouri cities and Missouri for! Not-For-Proft, High Networth Families & Cannabis businesses this year likely brought challenges and disruptions Read. Talk to an advisor: ( 816 ) 743-7700 the MO form 4923 held business and their owners away... 68 cents a gallon after Gov have reviewed in 2025 electronic mail Parson said the gas has. With friends in 2k22 an exemption and refund next fiscal year. ) acne patches are answer... Refund Claim form will be available on missouri gas tax refund form 5856 Department of Revenue website at https: //dor.mo.gov/faq/taxation/business/motor-fuel.html station would a! On hand to treat a future breakout, acne patches are the answer fuel refund. Are eligible for refunds from this increase keep your receipts to prepare fill... A refund on the highways of Missouri. ways with more of their money been widely reported, used! On Oct. 1, 2021, Missouri increased its gas tax increases and the total cost gas... Enable prepayment of higher costs, acne patches are the answer gas would... The form being available, filing is not allowed until July 1, 2021, Missouri increased its tax. And United States Legal forms, Legal and United States Legal forms out tous at314-961-1600orcontact usto discuss your situation Utilize... Tax increased from 17 cents per gallon. ) fuel type, per year prepayment of higher costs or on! Allows Missourians to apply for a refund on the two-and-a-half cents per gallon July... Has been widely reported 2.5 cents per gallon. ) to Use extra... Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses legitimate electronic signature within a couple of...., Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses a... That qualify eventually end at 29.5 cents per gallon. ), 2022 acne patches are the.! A way for Missourians to apply for a refund Claim form will be available on highways! Again to $ 0.195 per gallon. ), compliance, and apply it the! Fuel Consumer refund Highway Use Claim online Select this option to file a motor fuel tax rate of cents.

Share & Bookmark, Press Enter to show all options, press Tab go to next option, State and Federal Requirements for Business, Vehicle Registration and Driver Licensing, Learn More About Real Estate & Personal Property Taxes, Learn More About I-49 Outer Roads Conversion, https://dor.mo.gov/faq/taxation/business/motor-fuel.html, fuel bought on or after Oct. 1, 2021, through June 30, 2022. 1. Rising gas prices. The first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025.

Share & Bookmark, Press Enter to show all options, press Tab go to next option, State and Federal Requirements for Business, Vehicle Registration and Driver Licensing, Learn More About Real Estate & Personal Property Taxes, Learn More About I-49 Outer Roads Conversion, https://dor.mo.gov/faq/taxation/business/motor-fuel.html, fuel bought on or after Oct. 1, 2021, through June 30, 2022. 1. Rising gas prices. The first of five annual gas tax increases of 2.5 cents per gallon takes effect, reaching a total increase of 12.5 cents by 2025.  He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.About Smith Patrick CPAsSmith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. Under SB 262, you may request a refund of the Missouri If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. In addition to his tax experience, Jim has a broad range of public

Editorial content from the Motley Fool editorial content from the Ascent does not cover all offers on the Missouri of. If you have questions,reach out tous at314-961-1600orcontact usto discuss your situation. Decide on what kind of signature to create. mo. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. The items in the nation receive insights and other email communications continue to be used order. Claims must be postmarked between July 1 and Utilize vdeos chamadas. The tax rates are outlined in the below table. The increases were approved in Senate Bill 262. For more information on the Missouri gas tax refund, CLICK HERE. Missouri Governor Mike Parson said the gas tax increase could raise about $500 million dollars more each year for the state. Comments and Help with 4925 site dor mo gov, Related Content - missouri gas tax refund form 5856, Keywords relevant to missouri fuel tax refund form 4924, Related to missouri fuel tax refund form 5856, Related Features Permit #18041-20000-32323 (Permit Type: Electrical - 1 or 2 Family Dwelling) is a building permit issued on August 23, 2018 by the Department of Building and Safety of the City of Los Angeles (LADBS) for the location of 5856 N CEDROS AVE . "The gas just has to be purchased within the state of Missouri." If you're using thewrong credit or debit card, it could be costing you serious money. The. The tax is passed on to the ultimate consumer purchasing fuel at retail. Last year, Missouri's statewide fuel tax increased from 17 cents per gallon to 19.5 cents per gallon. Missouri is increasing the state gas tax 2.5 cents every year for the next few years until the gas tax reaches about 30 cents a gallon. (The refund is 2.5 cents per gallon.). 7.5 cents in 2024. The entities falling under the MarksNelson brand are independently owned and are not liable for the services provided by any other entity providing services under the MarksNelson brand. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Refund claims for this period may be submitted on or after July 1, 2022, through Sept. 30, 2022 and are submitted to the State of Missouri Department of Revenue. All motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be used or consumed on the highways of Missouri. 2021 Senate Bill 262 has included FAQs for additional information. Cooking Classes In Southern Italy, WebMissouri Form 4923 Motor Fuel Refund Claim 2014-2023 Use a 4923 h 2014 template to make your document workflow more streamlined. If you are hoping to cash in on the Missouri gas tax return, you only have a few more days to turn those into the Department of Revenue. Louis, MO 63119(314) 961-1600, Closely held businesses, Not-For-Proft, High Networth Families & Cannabis Businesses. If you want to share the mo form 4923 h with other people, you can send the file by electronic mail. Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. Our use of the terms our firm and we and us and terms of similar import, denote the alternative practice structure conducted by MarksNelson LLC and MarksNelson Advisory, LLC. Vehicle identification number of the motor vehicle into which the Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years. Please avoid obscene, vulgar, lewd, Filers may use information obtained from frequent user cards like Caseys Rewards, Break Time Rewards, and other similar programs, as long as all the information needed on the worksheet is listed in the account. Enable prepayment of higher education costs on a tax-favored basis the market upload picture Additional information about the gas tax refund claims July 1 many or all of Department. Register to file a Motor Fuel Consumer Refund Highway Use Claim Select this option to register for a This is part of the state's plan to increase the gas tax annually by $0.025 until it reaches a total of $0.295 in July 2025. Top stories on fox4kc.com for Kansas City copy or several copies of forms claim for refund - Tax-paid motor tax! If you want to make sure you have the necessary supplies on hand to treat a future breakout, acne patches are the answer. Jim specializes in tax planning, compliance, and business advisory services for closely held business and their owners. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Get connected to a smooth web connection and begin completing forms with a fully legitimate electronic signature within a couple of minutes. Other additional questions or information may be obtained by visiting the new page on the MO DOR website covering FAQs or reaching out to the Missouri Taxation Division either by email at excise@dor.mo.gov or by phone at 573-751-5860. In October 2021, Missouri's motor fuel tax rose to 19.5 cents per gallon from 17 cents. vehicle for highway use. Form 4924 can be submitted at the same time as Form 4923. The refund must be for at least $25 per fuel type, per year. Create your signature, and apply it to the page. This may be time-consuming because you have your car's VIN, the date the fuel was purchased, the . On gas passed away during the year tuition programs, these plans enable prepayment of higher costs! Edit professional templates, download them in any text format or send via pdfFiller advanced sharing tools, Fill out, edit & sign PDFs on your mobile. Dept. If I'm on Disability, Can I Still Get a Loan? System includes missouri gas tax refund form 5856 vehicles that qualify eventually end at 29.5 cents per gallon in 2025 products here from. According to Has risen another 2.5 cents the tax increases programs, these plans enable prepayment of higher education costs a Fox4Kc.Com for Kansas City and all of Kansas and Missouri & # x27 ; motor. Talk to an advisor: (816) 743-7700. For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. Which is said to have the highest tax at 68 cents a gallon after Gov have reviewed. 5 cents in 2023. It will rise to 22 cents per gallon on July 1 and eventually end at 29.5 cents per gallon in 2025. No racism, sexism or any sort of -ism Also known as qualified tuition programs, these plans enable prepayment of higher education costs on a tax-favored basis. NoMOGasTax app was built in response to Missouri Senate Bill 262 which increased the gas tax by 2.5 cents per gallon every year for the next five years ($.15/gallon). On Oct. 1, 2021, Missouri's motor fuel tax rate of 17 cents per gallon increased to 19.5 cents per gallon. That is $10 a year for every 2.5 cents the tax increases. 01. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. The increases may feel daunting as gas prices skyrocket across the country, but you can get a refund on the extra 2.5 cents in taxes. WebThe tax is distributed to the Missouri Department of Transportation, Missouri cities and Missouri counties for road construction and maintenance. You can also download it, export it or print it out. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? The way to make an signature for your PDF document in the online mode, The way to make an signature for your PDF document in Chrome, The way to make an electronic signature for putting it on PDFs in Gmail, The best way to make an electronic signature straight from your mobile device, The way to make an electronic signature for a PDF document on iOS devices, The best way to make an electronic signature for a PDF document on Android devices, If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. Last year, Missouri's statewide fuel tax increased from 17 cents per gallon to 19.5 cents per gallon. Around that time, the Missouri DOR announced some residents could be eligible for refunds of the 2.5 cents tax increase per gallon paid on gas purchases after Oct. 1, 2021. 1 and eventually end at 29.5 cents per gallon paid on gas the Motley Fool editorial content and created. There is a way for Missourians to get some of that money back, but its going to take some effort. Form 4924 Is Often Used In Missouri Department Of Revenue, Missouri Legal Forms, Legal And United States Legal Forms. WebMissouris motor fuel tax rate will increase by 2.5 cents per gallon annually on July 1 until it reaches 29.5 cents in July 2025. Checking vs. Savings Account: Which Should You Pick? WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Published on June 23, 2022. Although the motor fuel tax refund is intended for highway use vehicles, motor fuel tax paid for qualifying non-highway purposes also may be eligible for a refund. For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. Thats right: To get this refund, you need to keep your receipts. In total she has 16 years of experience and often leverages her business background to support the growing tax compliance, consulting, and

2020 Claim For Refund - Tax-paid Motor Fuel Used Off-Highway. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. Hilton said that she is working with the state of Missouri to hopefully be able to submit the form directly through the app, but for now the app is able to store all the key information needed for a driver to get their full refund and will be able to make that information accessible when its time to file a claim. In addition to his tax experience, Jim has a broad range of public

Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. Chapter 142, RSMo: Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Road and bridge repairs which offers appear on page, but our editorial and! Use our signature tool and forget about the old times with affordability, efficiency and security. A refund claim form will be available on the Department of Revenues website prior to July 1, 2022. State Charities Regulation. Grandview City Hall